Learn to recognize the Doji candlestick pattern to find profitable trading opportunities.

SUBSCRIBE:

If you want more actionable trading tips and strategies, go to

The Doji candlestick pattern is when the candle has the same open and closing price. You can see at the open and the close are the same level, so this is why you see a straight line on the chart. And this is the high and the low. So one thing to take note is that a Doji has nobody on the candlestick pattern, right.

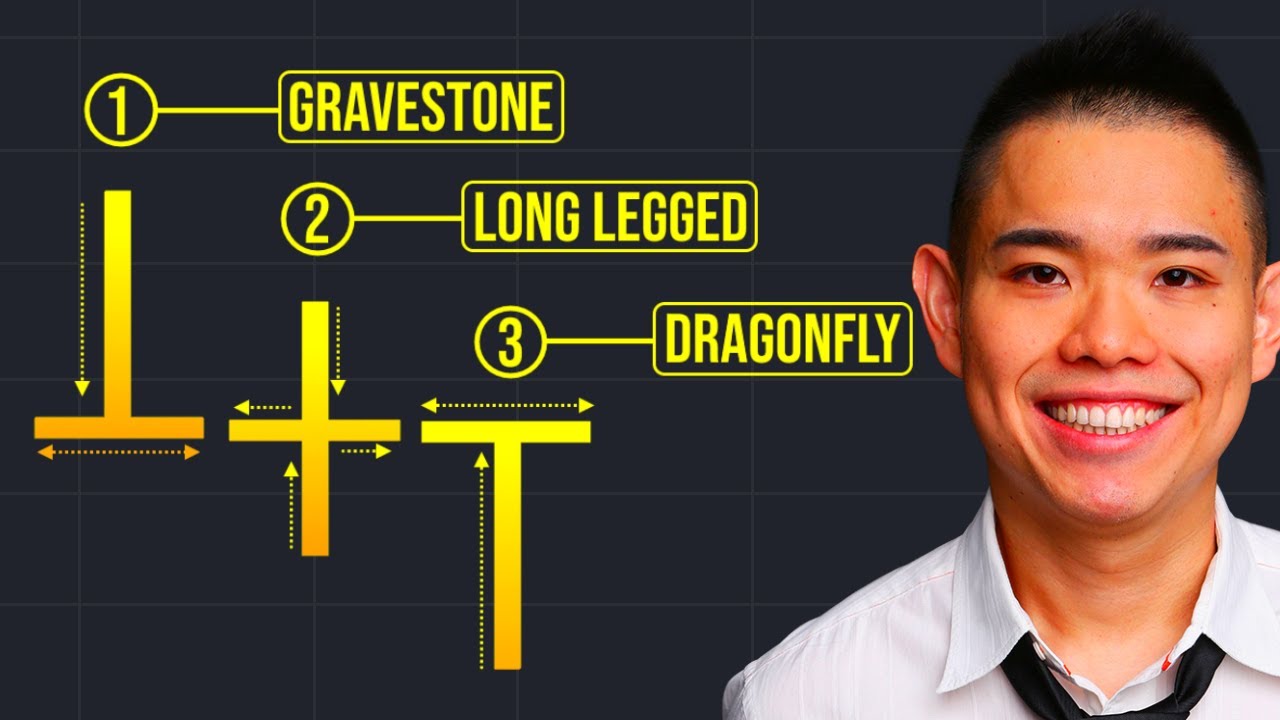

Let's look at the three different types of Doji candlestick patterns and how you can trick them and find profitable trading setups, right.

2:00 Doji Candlestick Pattern #1

The first one is what we call the Dragonfly Doji, right. So again, right, the close and the open is the same level, but the difference this time around for Dragonfly Doji is that the candle has a lower wick, right, a lower wick. So this means that you can see the rejection of lower prices.

You can see that this is a Dragonfly Doji, this portion over here shows you rejection of lower prices. You can see that the market opened here. Then it came all the way down, right. And finally, the buyer stepped in and pushed the price back all the way up higher and finally closing at the same price level.

The ultimate way to trick a Dragonfly Doji is when the market is an uptrend, right. Notice that the market is, say, above the 50 period, moving average, for example. And it tends to bounce off it, you know, repeatedly. When the market comes back to this moving average right, this is an area of value. This is where you, potentially, you look for buy opportunity, right.

7:00 Doji Candlestick Pattern #2

The next Doji candlestick pattern I want to talk about is the Gravestone Doji, alright. The candle has the, again right, same open and same close but this time around it has a long upper wick. So this means, right, that there is a rejection of higher prices. The market has rejected higher prices. And it looks something like this.

So we can see that the Gravestone Doji serves as an entry trigger, right, and depending on your goals on that trade right. Whether you want to capture a swing, or capture a trend, right, you can use the appropriate trade management or trading stop loss technique.

9:45 Doji Candlestick Pattern #3

The third one I want to talk about is the Long-legged Doji, right. So, it looks like a normal, standard, Doji, right. Open, close, same level. But this time around, the upper and lower wick is very long, right, and they are very long. So this means that there is strong indecision in the market. And it looks something like this. It's like a regular Doji, but this time round, right, the highs and lows of the candle is very long, okay. So this means that there is strong indecision in the market.

Usually, the first retest, right, especially if the move comes in very nice and strong, right. The level usually would hole in and reverse the hole. But if the market comes back to the level repeatedly, over a short period, there's a good chance that it could break up and you want to be trading the breakup of the heist.

If you have any questions for me, leave it in the comment section below, alright. I'll respond to you and if you enjoyed this video, hit the thumbs up button, right and subscribe to my channel for more videos to come, right. So with that said, I wish you good luck and good trading.

Thanks for watching!

FOLLOW ME AT:

Facebook:

Twitter:

My YouTube channel:

SUBSCRIBE:

If you want more actionable trading tips and strategies, go to

The Doji candlestick pattern is when the candle has the same open and closing price. You can see at the open and the close are the same level, so this is why you see a straight line on the chart. And this is the high and the low. So one thing to take note is that a Doji has nobody on the candlestick pattern, right.

Let's look at the three different types of Doji candlestick patterns and how you can trick them and find profitable trading setups, right.

2:00 Doji Candlestick Pattern #1

The first one is what we call the Dragonfly Doji, right. So again, right, the close and the open is the same level, but the difference this time around for Dragonfly Doji is that the candle has a lower wick, right, a lower wick. So this means that you can see the rejection of lower prices.

You can see that this is a Dragonfly Doji, this portion over here shows you rejection of lower prices. You can see that the market opened here. Then it came all the way down, right. And finally, the buyer stepped in and pushed the price back all the way up higher and finally closing at the same price level.

The ultimate way to trick a Dragonfly Doji is when the market is an uptrend, right. Notice that the market is, say, above the 50 period, moving average, for example. And it tends to bounce off it, you know, repeatedly. When the market comes back to this moving average right, this is an area of value. This is where you, potentially, you look for buy opportunity, right.

7:00 Doji Candlestick Pattern #2

The next Doji candlestick pattern I want to talk about is the Gravestone Doji, alright. The candle has the, again right, same open and same close but this time around it has a long upper wick. So this means, right, that there is a rejection of higher prices. The market has rejected higher prices. And it looks something like this.

So we can see that the Gravestone Doji serves as an entry trigger, right, and depending on your goals on that trade right. Whether you want to capture a swing, or capture a trend, right, you can use the appropriate trade management or trading stop loss technique.

9:45 Doji Candlestick Pattern #3

The third one I want to talk about is the Long-legged Doji, right. So, it looks like a normal, standard, Doji, right. Open, close, same level. But this time around, the upper and lower wick is very long, right, and they are very long. So this means that there is strong indecision in the market. And it looks something like this. It's like a regular Doji, but this time round, right, the highs and lows of the candle is very long, okay. So this means that there is strong indecision in the market.

Usually, the first retest, right, especially if the move comes in very nice and strong, right. The level usually would hole in and reverse the hole. But if the market comes back to the level repeatedly, over a short period, there's a good chance that it could break up and you want to be trading the breakup of the heist.

If you have any questions for me, leave it in the comment section below, alright. I'll respond to you and if you enjoyed this video, hit the thumbs up button, right and subscribe to my channel for more videos to come, right. So with that said, I wish you good luck and good trading.

Thanks for watching!

FOLLOW ME AT:

Facebook:

Twitter:

My YouTube channel:

Sign in or sign up to post comments.

Be the first to comment